Stewardship and Engagement Report is the name of the document which analyses the results achieved through our dialogue with the management, voting at shareholder meetings of companies in which Etica Funds invests and advocacy with governments, regulators and standard setters.

We promote a sustainable development model based on the premise that the financial community can play a vital role in directing capital towards sustainable actions. With our Stewardship activities, we set ourselves the goal of raising awareness among the businesses in which our funds are invested to promote greater corporate social responsibility.

The stewardship strategy Etica pursues is in line with our Engagement Policy and sets two objectives:

- To promote the integration of social and environmental sustainability into the strategies of issuers in which the funds are invested.

- To generate financial benefits in terms of lower volatility and higher growth potential of the securities in the portfolio.

Etica relies on three key tools to pursue these activities: dialogue, voting and advocacy.

What does engagement mean?

It is “the process through which the investor initiates structured dialogue with the management of the subsidiary company (and/or company under review), on the basis of the continuous monitoring of the environmental, social and governance factors related to company activities” (definition by the Forum per la Finanza Sostenibile [Italian Sustainable Investment Forum]).

What does stewardship mean?

The word steward comes from old English and is made up of the words stig, meaning house or hall, and weard, ward or guard. Literally, this denotes the “guardian of the home”. In the XIV century, in England and Scotland, the steward was a high-ranking official whose job was to manage a property on behalf of the lord. Stewardship activity, in our case managing the savings entrusted to us by our clients, is aimed at preserving and increasing the value of their investments. And in doing this, we pay the utmost attention to the social and environmental impact of our funds. Stewardship implies a broader and more inclusive undertaking than the term Engagement, which mainly refers to the tools of dialogue and voting.

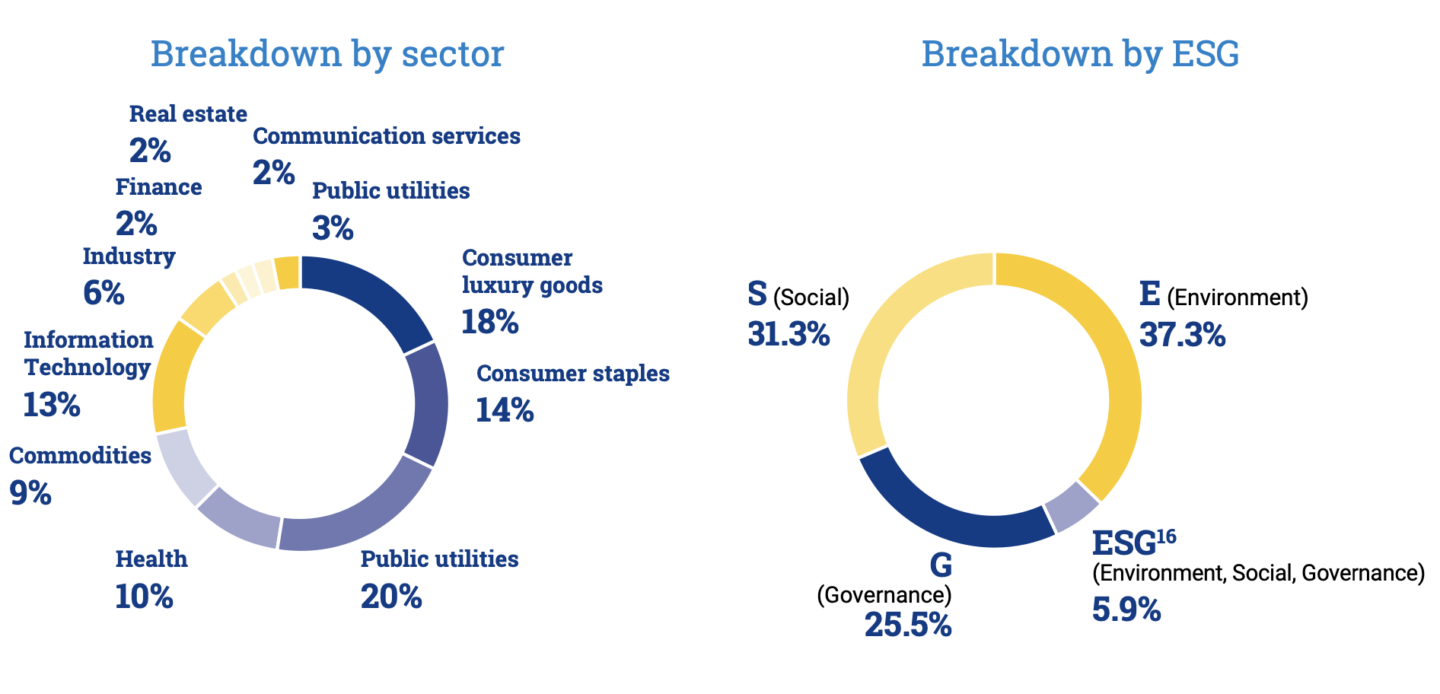

Results of the dialogue

During 2021, we engaged in dialogue with 142 international companies, posing almost 1.000 questions to managers on socio-environmental and corporate policy issues. Etica dialogue was undertaken with written requests for information, organising conference calls, meetings or workshops with businesses.

142

International companies with which Etica engaged in dialogue

971

Questions on ESG issues posed by Etica

21

Countries

Results of the vote

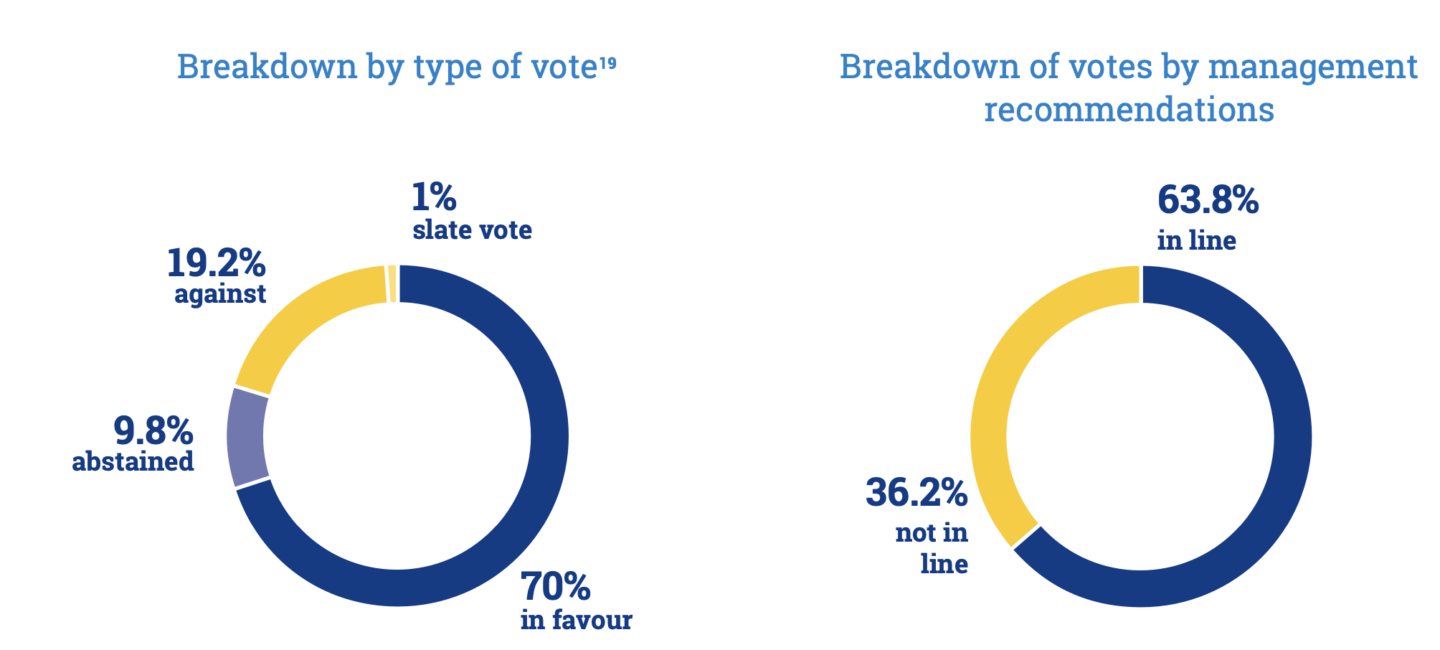

As regards voting, in relation to the voting on the Board of Directors (BoD), we strengthened the focus on the independence and gender and ethnic diversity (for the US market) of board members, as well as on the reporting of climate risks in line with the recommendations of the TCFD. Furthermore, the integration of ESG targets into remuneration plans has become indispensable on the Italian and US markets. Finally, Etica supported 36 motions put forward by shareholders.

512

Number of shareholders’ meetings in which Etica Funds voted

60

Agenda items addressed

85%

Voting percentage not in line with management’s recommendations

Advocacy results

With regard to advocacy, we have established a channel of communication with the Italian Ministry of the Economy and Finance (MEF) dedicated to the standards for Green BTPs. Moreover, in

the year in which the Treaty on the Prohibition of Nuclear Weapons came into force, we launched an international campaign to promote divesting from nuclear weapons, in partnership with the non-governmental organisation ICAN, which was awarded the Nobel Peace Prize in 2017.

22

Total questions

2

Supranational entities or sovereign States contacted

9

Campaign supported

Please read the Notice.