Banca Etica increases its share in Etica Sgr to 51% – Luca Mattiazzi named Managing Director

June 29th, 2016_Banca Popolare Etica has purchased a majority share in Etica Sgr, the Group’s asset management company. With the acquisition, Banca Etica has increased its ownership from 46.47% to 51.47% of Etica Sgr’s share capital.

The transaction was agreed upon by all shareholders in order to solidify Etica Sgr’s affiliation with Banca Etica, which up until today had only been possible thanks to specific shareholders’ agreements.

The shares needed to reach 51.47% were purchased from Banca popolare di Milano, which continues to be the second-largest shareholder with 19.44% of Etica Sgr’s share capital. There have been no changes in the share ownership of the other shareholders: BPER Banca (10%); Banca popolare di Sondrio (9,87%); Cassa Centrale Banca (9,22%).

Banca Etica’s General Manager, Alessandro Messina, had this to say about the acquisition: “Banca Etica is continuing its pioneering work as an innovator in the financial market. Nothing like Etica Sgr had ever been seen before in Italy when it started thirteen years ago: it brought responsible investment funds to our country. In turn, these funds brought the founding principle of ethical finance to stock markets: namely, that investors must be made fully aware of how their money is being used. Today, Etica Sgr is a leading manager of sustainable funds in Italy and one of the main players on the European market. We want to continue to grow, but we also want to make sure that our business operations are consistent with our mission. For this reason, Banca Etica decided to increase its share in Etica Sgr to 51%, which firmly establishes us not only as the leading shareholder, but also as the leader of this initiative. Of course, much is owed to the other shareholders – BPM, BPER, Popolare di Sondrio and Cassa Centrale – but Banca Popolare Etica has always been the guiding hand that has set Etica Sgr apart. And just as we helped create it, so too will we now help it grow.”

In addition, Etica Sgr’s Board of Directors named Luca Mattiazzi as the company’s Managing Director. Mattiazzi became a member of Etica Sgr’s Board in April 2015; previously, he was Director of Etica Sgr between 2002 and 2006, a period that saw him lead the company through its start-up and consolidation phase. Mattiazzi is a founding member of Banca Etica, where he has worked since 2006. Before coming to the Banca Etica Group, Mattiazzi held important positions in the financial sector in Italy and abroad.

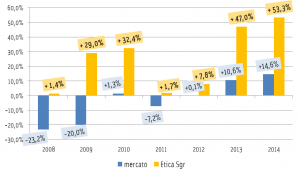

Etica Sgr closed the fiscal year 2015 with a net income of 3.4 million euros (+90% compared to 2014) and commission income of 25 million euros (+83%). In the first quarter of 2016, the company once again reaffirmed its position as market leader in the field of ethical funds, with a market share of 49% (based on Assogestioni statistics). In May 2016, Etica Sgr’s “Valori Responsabili” funds surpassed 2.4 billion euros in assets under management (+16% compared to 2015), while net inflows have surpassed 316 million euros since the beginning of the year. The number of clients has risen to 139,000, which represents a net growth of 20% in the first five months of the year.

Banca Etica is the first and only Italian bank that is entirely dedicated to ethical banking. It covers all of Italy thanks to its network of branches and financial advisors, in addition to its online banking and mobile banking services. Banca Etica manages the savings of responsible organizations and citizens and provides financing exclusively for projects that focus on the collective well-being. From its foundation in 1999 to today, Banca Etica has provided families, businesses and organizations with about 30 million euros of financing for over 25 thousand initiatives dealing with social cooperation, international cooperation, culture, quality of life, protection of the environment, the right to housing, and lawfulness. In 2014, Banca Etica opened its first foreign branch in Bilbao, Spain.

Responsible finance