Stewardship Report 2024 is the name of the document that analyzes the results of the dialogue with management, of the active shareholding carried out with the companies in which Etica’s funds invest and of the advocacy activity carried out with governments, regulators and standard setters.

At Etica we promote a model of responsible development, starting from the assumption that the world of finance can play a fundamental role in directing capital towards sustainable activities. For this, we interact with the issuers in which the funds invest.

The activity is consistent with Etica’s Engagement Policy and has the following objectives:

- Promote the integration of socio-environmental sustainability into issuers’ strategy.

- Generate financial benefits in terms of lower volatility and greater growth potential of the invested securities.

There are three tools used by Etica Sgr to carry out this activity: dialogue, voting and advocacy.

What does Stewardship mean?

The term derives from Old English and is composed of the word stig or “hall” or “part of a house” and weard from Proto-Germanic “guard”. Literally it would be “guardian of the house” or “housekeeper”. In the late 14th century Steward was the title of a class of high officials in England and Scotland meaning “one who manages the affairs of an estate on behalf of his employer” (late 14th century). And, through this definition, we arrive at the meaning of the activity described in this document. Stewardship activity (i.e. “business management on behalf of savers”) aims to preserve and increase the value of the savings entrusted to us, taking care to manage the environmental and social impact of investments made with such savings. The concept of Stewardship is, therefore, broader and more complex than the term “Engagement”, i.e. the manager’s activity of dialogue and active ownership with a specific and targeted objective towards the companies in which the funds invest, which represents one of the tools of “Stewardship”.

The results of the dialogue

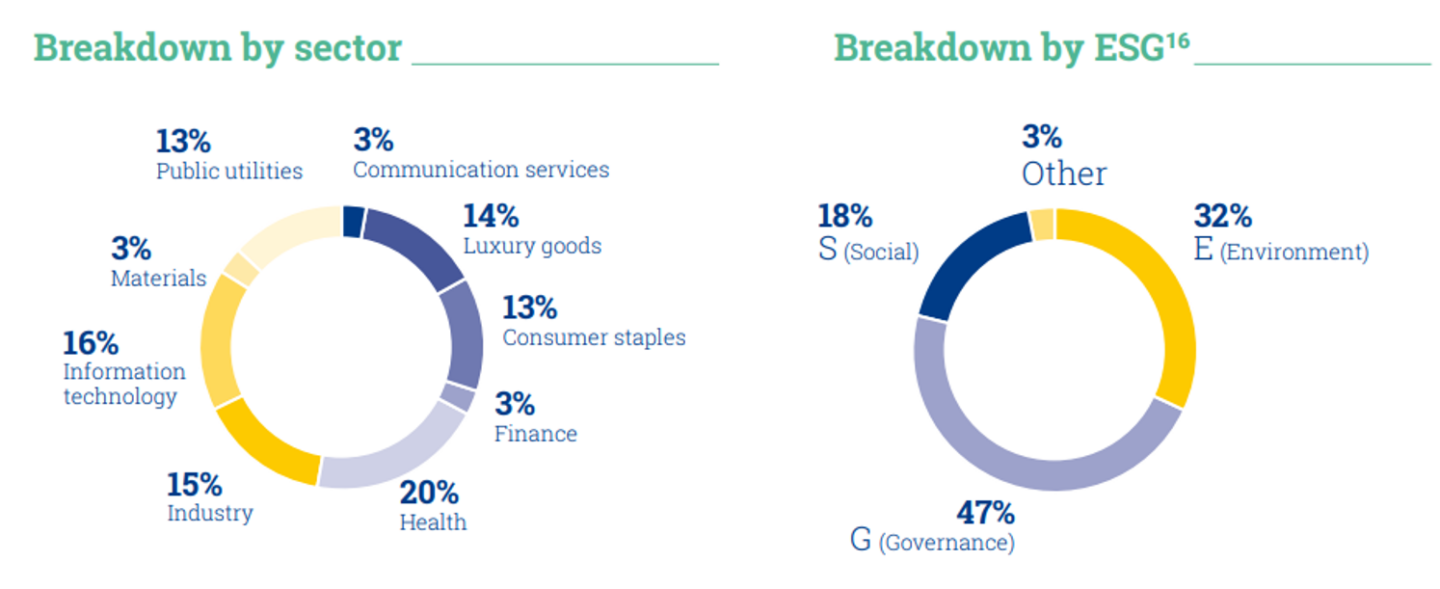

As regards dialogue with businesses, we continued on the topic of biodiversity, in line with the commitments made by signing the Finance for Biodiversity Pledge. We have intensified our engagement on the topic of tax transparency, also thanks to our participation in the PRI reference group and with the support of a specialized service provider. During our participation in the PRI in Person event in Tokyo, we organized meetings with 19 Japanese companies and visited two research and development facilities.

113

International companies with which Etica has dialogued

655

Questions on ESG issues from Etica

15

Countries

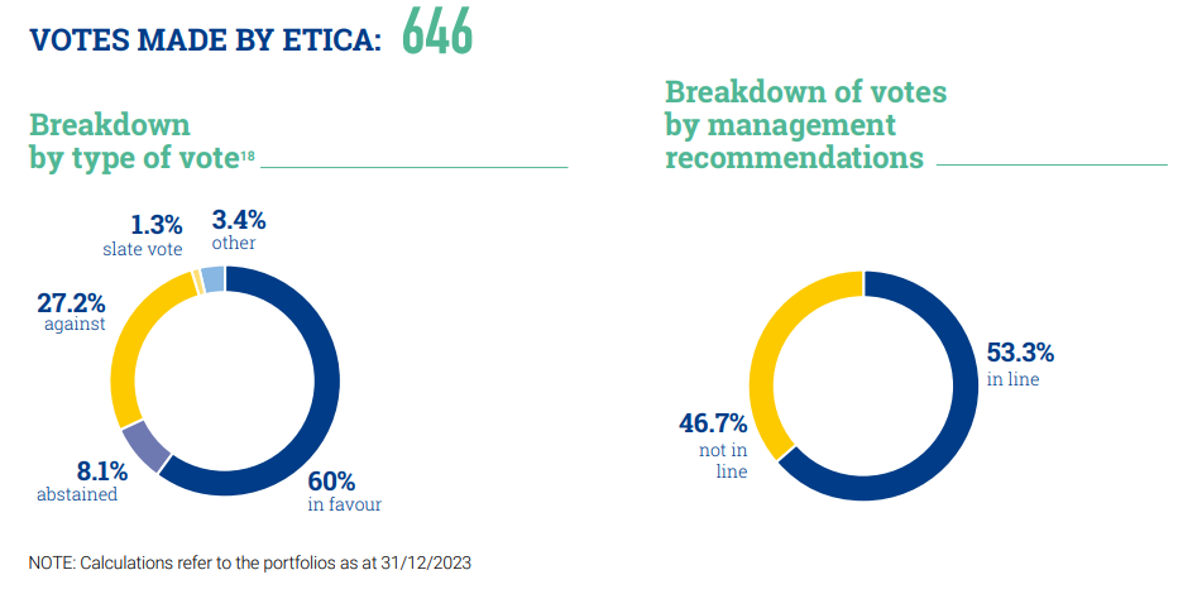

The results of the vote

For the first time in our history, we presented a motion on the topic of tax transparency at the meeting of an American company, as lead-filer. The motion received the support of more than 25% of voters, representing more than 780 million shares.

646

Etica votes at the assemblies in which he participated

70

Number of meetings in which Etica voted

84

Shareholder motions voted on

The results of advocacy

Together with the ICAN network, we have updated the investor statement on the topic of nuclear weapons written in 2022. The statement was signed by 111 international investors, with total AUM of over 1,000 billion dollars. We also participated in public consultations, in particular the one called by the Australian parliament regarding a proposal to regulate the issue of tax transparency.

3

Supranational bodies or sovereign states contacted

9

Supported campaigns

7

Specific campaigns aimed at supranational bodies or sovereign states

Download the 2024 Report

Please read the Legal Notice.