The Impact Report, now in its fifth edition, is Etica FUNDS’s tool for measuring the impact of securities selection (compared with the benchmark1) and its engagement activities, in particular the dialogue with the companies in which our funds invest.

In the document we measure the impact of our work in screening the securities and, since 2018, our engagement activity, specifically dialogue, with the firms in which our funds invest.

How we calculate impact

We measure the impact of our investments using indicators linked to the United Nations Sustainable Development Goals set out in the 2030 Agenda global framework for sustainable development signed by the governments of 193 UN Member States to try and reconcile economic growth with social inclusion and environmental protection.

Calculation for “The impact of selection”

The results presented in this document derive from a process of analysis, research and evaluation by Etica FUNDS based on data provided by Bloomberg and the Science Based Targets Initiative. The scope of the analysis is the entire equity portfolio of Etica’s funds, compared with the benchmark for the equity portion of the funds, i.e. the MSCI World Net Total Return (in Euro), as the market reference. The date of reference for the composition of the companies included in the analysis of the equity investments of Etica FUNDS and of the benchmark is 31 December 2020. Overall, more than 570 ESG indicators were considered, associated by Etica FUNDS with the Sustainable Development Goals. Of these, only those with a coverage threshold of more than 70% were identified and considered, for both the companies in the portfolio of Etica’s funds and for the benchmark, equal to 185 indicators. As in previous years, the exception is the indicator on setting emission reduction targets, for which data is only available for companies that have set targets or made a commitment to do so. Coverage, considering only those companies that have actually set a target, is itself the indicator used to calculate the delta.

Only a selection of the indicators analysed has been published in this report, taking into account areas with a high level of indirect materiality, as defined by the Social Responsibility Policy of Etica FUNDS1, and those defined as strategically important for the activity of dialogue with companies, defined in Etica’s Engagement Policy2. Moreover, the indicators for each area of the report have been associated with specific targets that refer to the United Nations Sustainable Development Goals. Each impact indicator is calculated as the delta between the percentage of companies that meet a given criterion in the equity investments of Etica FUNDS (a) and the same percentage for the benchmark (b), i.e.:

delta = (a-b)/b multiplied by 100

Example. Companies that make a public commitment to combat climate change: Etica FUNDS=80,75% Benchmark=63,44%. The impact is +27%, or (80.75%- 63.44%)/63.44% multiplied by 100.

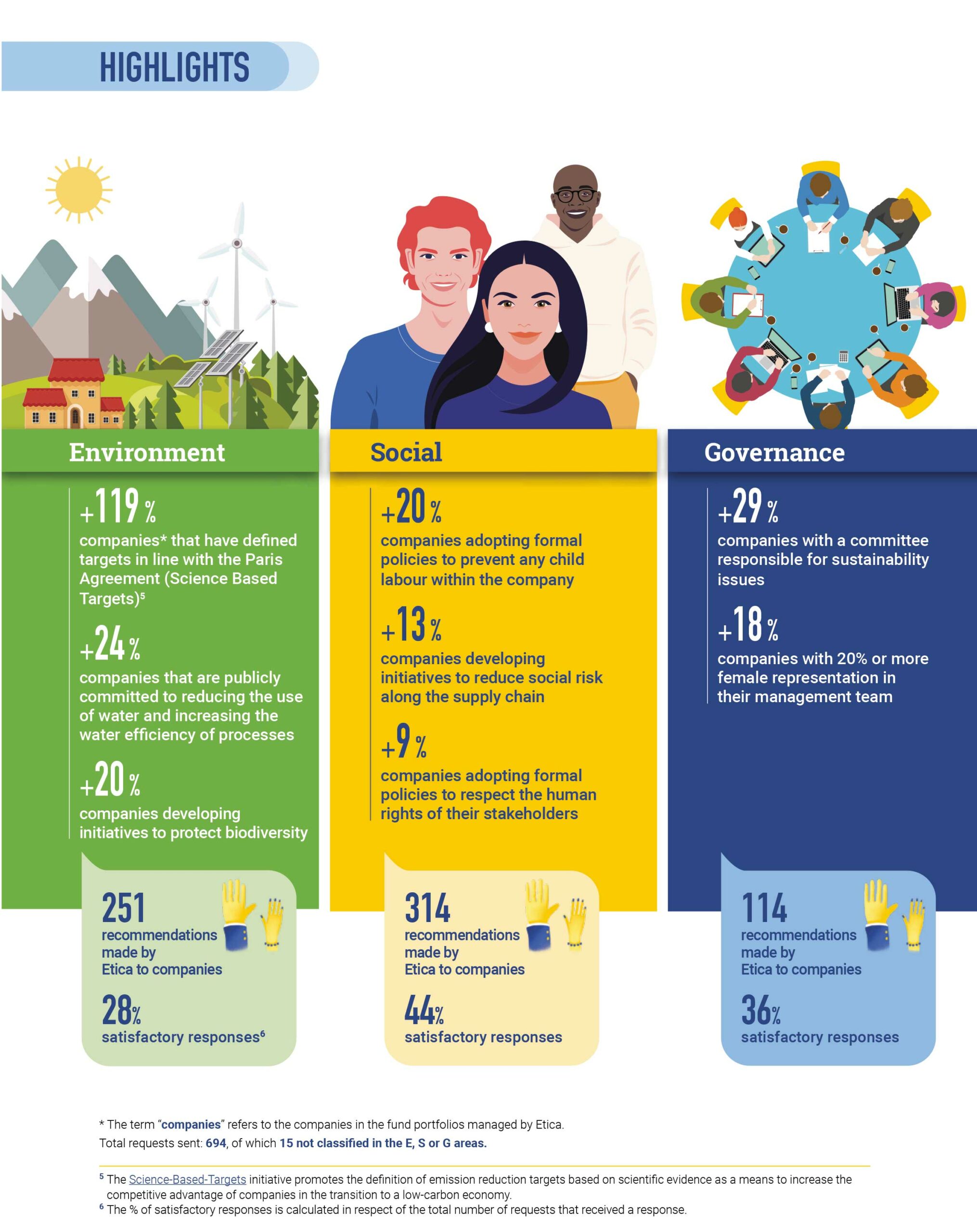

Calculation of “The impact of dialogue”

The data on dialogue activity were processed on the basis of the data collected by Etica FUNDS, the scores assigned analysts at Etica FUNDS and the responses given by companies with which dialogue took place during the year. The score is based on an ascending of 0 to 5. Scores were assigned according to the completeness of the response the level of detail provided and the proactiveness shown by the company. The data on the response rates to the various dialogue areas is calculated ratio between answers received to which it was possible to attribute a rating and questions asked by Etica FUNDS, for area. Only questions put directly by FUNDS to the companies were included in this calculation, and not questions during collaborative dialogue initiatives with other investors.

Example. “Has the company set targets for the reduction of climate-changing emissions approved by the Science Targets initiative?”. If Etica FUNDS evaluates the company’s response as “partially satisfactory”, response is given a score of 3 (on a of 0 to 5).

The impact report 2021: the main results

Why do we calculate impact

The Impact Report demonstrates with the force of numbers that it is possible to make a difference, showing clients and other stakeholders the concrete results of taking sustainability seriously. Those who have the planet’s sustainable development at heart can thus take informed investment decisions that combine growth and sustainability.

Please read the Notice.