This document is a commented summary of the Climate Impact Report released by the company ISS ESG[1] based on its proprietary methodology, concerning the holdings of Etica Impatto Clima fund (also referred to as “the portfolio”). The report includes metrics aligned with the guidelines of the Task Force on Climate-related Financial Disclosures (TCFD[2]).

All asset classes have been analysed according to the TCFD recommendations, grouped as follows: Equity Portfolio and Corporate Bonds Portfolio together and, Sovereign Bonds Portfolio.

The analysis outlines the climate performance calculated on the portfolio at the end of March 2023. It is divided into the following sections: carbon metrics, scenario analysis, transitional climate risks analysis, physical risks, sovereign bonds.

- Carbon metrics

- Scenario Analysis

- Transitional climate risks analysis

- Physical risks

- Conclusions

- Sovereign bonds

Carbon metrics

The carbon metrics used in the Equity and Corporate Bonds analysis are the following ones and are explicitly recommended by the TCFD:

- Relative Carbon Footprint: defined as the total scope 1 and scope 2 GHG emissions of the portfolio, directly attributable to the investor through its ownership share in companies’ total market value (also defined as “Emissions Exposure”), per million EUR invested. It is measured in tCO2e/EUR million invested.

- Carbon intensity: defined as the total scope 1 and 2 GHG emission intensity of the portfolio (based on issuers’ revenues), directly attributable to the investor through its ownership share in the companies’ total market value. It is measured in tCO2e/EUR million revenue.

- The Weighted Average Carbon Intensity (WACI): expresses scope 1 and 2 GHG emission intensity (based on issuers’ revenues), proportional to the issuers’ weight in the portfolio. Hence, this does not take the ownership share into account. It is measured in tCO2e/EUR million revenue.

Overall, the relative carbon footprint of the portfolio amounts to 43,37 tCO2e/EUR million. The carbon intensity is 103,51 tCO2e/EUR million, the weighted average carbon intensity is 75,91 tCO2e/EUR million.

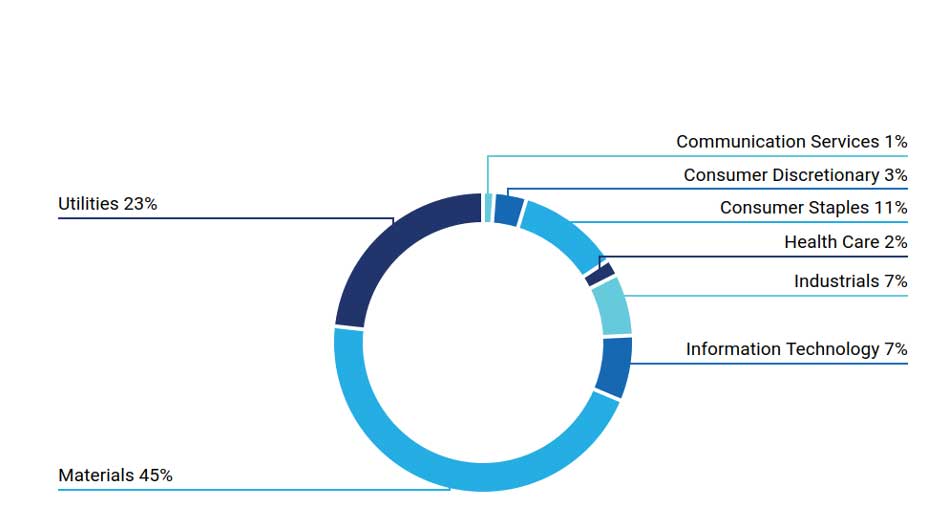

Sector contribution to emissions in Etica Impatto Clima

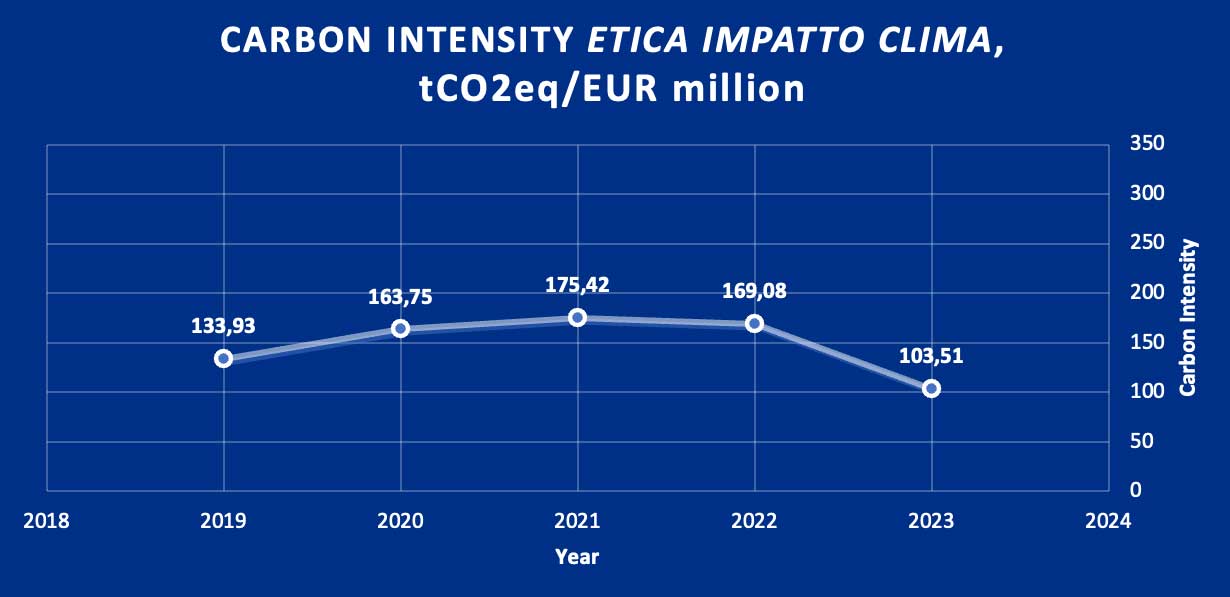

Comparison with Etica Impatto Clima year-end 2021.

Based on the carbon footprint analyses performed over time, in 2021, the selection methodology has been amended to improve the carbon footprint of the funds, by introducing specific criteria to evaluate companies involved in natural gas activities and companies in high carbon-intensity sectors. During 2022 a specific climate assessment was included in the methodology to further enhance Etica’s selection approach. The effects of such changes are fully applied to the portfolios by March 2023.

There is evidence of a dramatic decrease in the carbon intensity of Etica Impatto Clima since 2021 thanks to methodological interventions that occurred during 2021 and 2022 and to the positive performance of companies previously selected for investments. From 2021 to 2023Q1 the portfolio’s carbon intensity dropped by 40,99%.

| Year of reference | Relative carbon footprint tCO2e/EUR million invested | Carbon intensity tCO2e/EUR million revenues |

WACI tCO2e/EUR million revenues |

Carbon intensity Year on Year change (%) |

| 2019 | 78,31 | 133,93 | 92,13 | |

| 2020 | 107,97 | 163,75 | 164,54 | +78,60% |

| 2021 | 70,33 | 175,42 | 154,56 | -6,07% |

| 2022 | 74,33 | 169,08 | 148,04 | -3,61% |

| 2023 Q1 | 43,37 | 103,51 | 75,91 | -38,78% |

The carbon intensity of the portfolio at year-end 2021 was 175,42 tCO2e/MEur and that of the same portfolio with the latest available data in March 2023 is 155,51 tCO2e/MEur. Therefore, it can be calculated that portfolio turnover from the end of 2021 to March 2023, net of any change in emissions data, contributed to reducing emission intensity by 28%. This means that the change in the portfolio’s composition explains 68,8% of the gap, while the change in emissions data accounts for 31% of it.

| Carbon intensity change 2021-2023Q1,

of which |

40,99% |

| Change in emissions data, keeping portfolio constant | 12,80pp |

| Change in portfolio turnover | 28,19pp |

Scenario Analysis

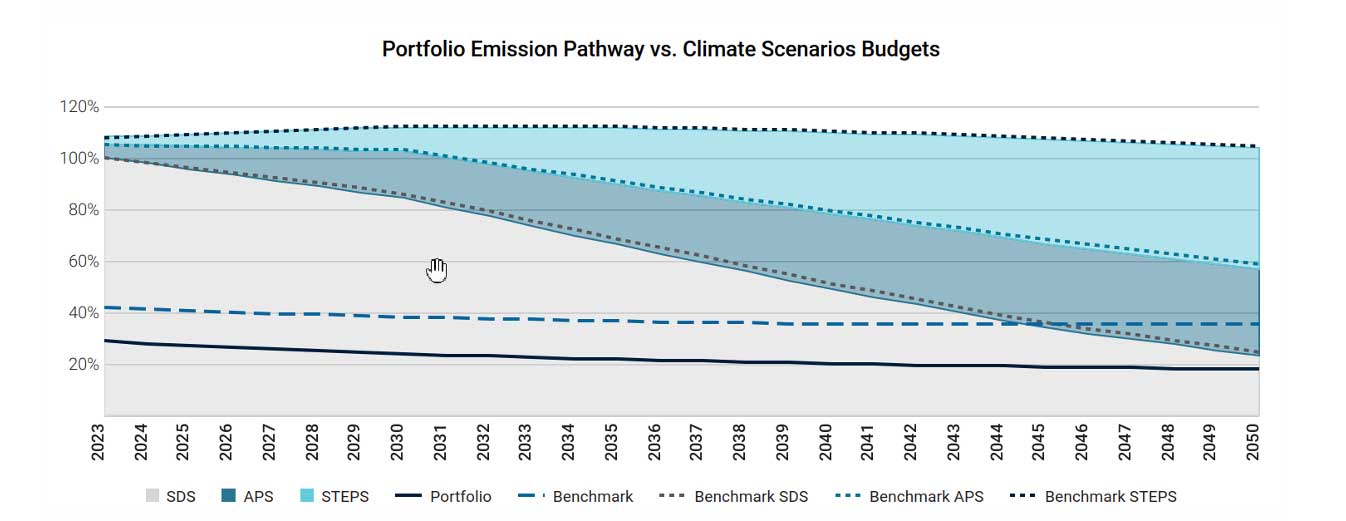

The purpose of the scenario analysis is to examine the current and future emission intensity from the direct and indirect emissions of a company (GHG scope 1&2) to see which climate scenario it is aligned with, until 2050. Each company’s carbon budget is defined based on its current and estimated future market share.

The scenario analysis compares the current and future portfolio’s GHG emissions with the carbon budget estimated in different IEA scenarios: Sustainable Development Scenario (SDS), Announced Pledges Scenario (APS) and Stated Policies Scenario (STEPS)[3]. Each scenario is tied to a carbon budget, i.e. a limited amount of fossil carbon that can be combusted worldwide to remain within a certain temperature. The carbon budget changes depending on the scenario, with the Sustainable Development Scenario being the most ambitious one, consistent with a global temperature increase well below 2°C by 2100, compared to pre-industrial levels.

Note: the “benchmark” line in the graph refers to the composition of Etica Impatto Clima portfolio at the end of 2021. This emphasises the change in scenario alignment after methodological interventions occurred in 2022.

Performance is shown as the percentage of the assigned budget used. The analysis shows that the portfolio at the end of March 2023 is, for the first time, aligned with a projected temperature increase of 1.5°C. In the analysis performed in 2022, Etica’s portfolio was associated with a temperature increase of 2.1°C by 2050.

The fund outperforms the market, proxied by the index MSCI World ESG Universal Net Total Return, which exceeds the budget of the SDS scenario already in 2026 and is associated with a temperature increase of 2.6°C by 2050.

The better performance of the portfolio compared to the market is explained by two factors, linked to the sectorial allocation and the single stock selection:

- The exclusion of most fossil activities from the portfolio

- A strict selection process concerning all remaining companies involved in any fossil-related activities and those in most polluting businesses.

- A higher number of companies with a commitment to reducing emissions compared to the benchmark.

Notably, 60% of the portfolio’s value (52% in the TCFD Report 2022) is covered by a GHG reduction target approved by the Science-Based Targets initiative (SBTi), against 45% of the market index.

Transitional climate risks analysis

The transitional climate risks analysis dives into the power generation mix of the portfolio.

Of the overall power generation installed capacity by companies in the portfolio, 53% comes from renewables. In the market index, the share of renewable energy capacity is around 23%.

The current energy generation mix of the portfolio is aligned with that in the Sustainable Development Scenario of the International Energy Agency in 2030, which envisages 84% of renewables in 2050 and 53% in 2030.

Transition risks decreased from 2021 to 2023Q1, with the exposure to fossil fuel reserves falling from 0,6% to 0% of total investments.

Physical risks

ISS employs a model to estimate the potential value losses, estimated by 2050, arising from the change in share price due to climate physical risks, computing the Value at Risk (VaR) of each issuer. The valuation model considers the following risks: changes in capital value via changes in Property, Plant and Equipment (PP&E), repair costs to damaged assets via investments in Capital Expenditure (CAPEX), increases in production costs via changes in Selling, General and Administrative Expenses, (SG&A) or Cost of Goods Sold (COGS), change in income via sales.

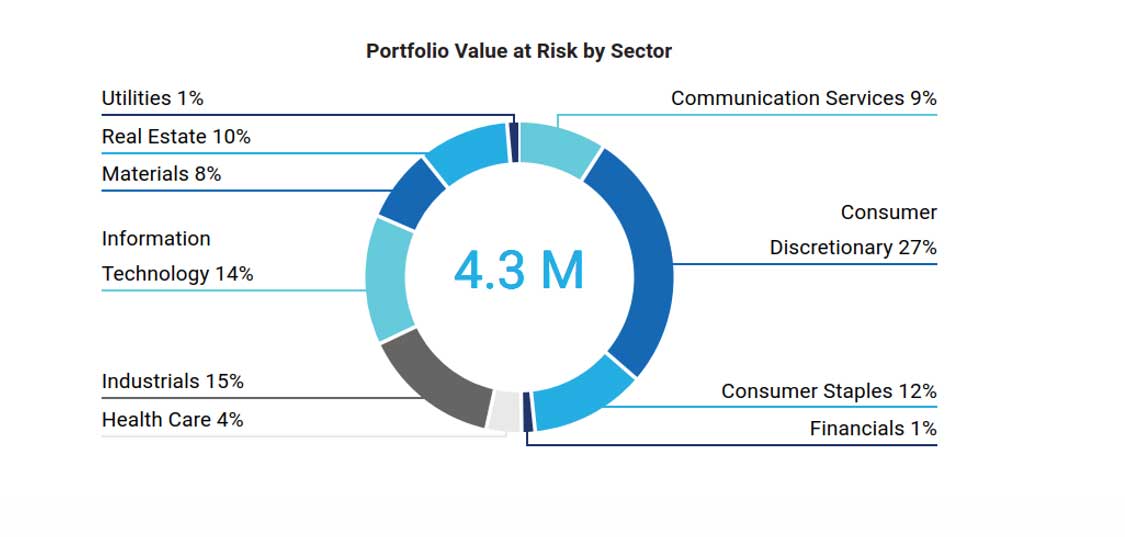

The analysis is based on the most relevant scenarios used as part of the IPCC 5th Assessment Report (AR5). The baseline scenario is built around Representative Concentration Pathway (RCP) 4.5 (1.7-3.2 ℃ temperature rise by 2100). In this scenario, the portfolio value at risk by 2050 is estimated to be 20 EUR million, with the Information technology and Consumer Discretionary being the most exposed ones. This represents a 0,8% loss in the overall portfolio value. The value at risk rises to over 32 EUR million if a worst-case scenario is employed, assuming a temperature increase over 3.2°C.

Conclusions

The main takeaway from the analysis performed in 2021 was to introduce a specific assessment of companies to reduce the carbon footprint of investment. During 2022 a specific climate assessment has been included in the methodology to better monitor GHG emissions in companies operating in Materials, Industrial and Utilities sectors and any business related to fossils. The effects of such changes are fully applied to the portfolios in March 2023 and proved to be highly effective in reducing the carbon footprint of the portfolio.

The carbon intensity at the end of March 2023 was almost 39% lower than at the end of 2022 and 41% lower than the portfolio at the end of 2021.

The scenario analysis shows that the portfolio is now, and for the first time, aligned with a projected temperature increase of 1.5°C.

This section compares the GHG emissions and other related carbon metrics for the sovereign bonds portfolio of Etica Impatto Clima against the benchmark, including absolute and relative values for the portfolio’s carbon emissions. Emissions are calculated based on the principles proposed by Platform Carbon Accounting Financials (PCAF)[4], allocating emissions to a sovereign bond through a government’s direct operations as well as from government financing in other sectors of society.

Metrics employed:

- Emission Exposure: it measures scope 1 and 2 GHG emissions of a country, weighted by the share of invested value relative to its GDP (PPP adjusted). It is measured in tCO2

- Weighted Average Carbon intensity: it is expressed as the weighted average scope 1 and 2 GHG emissions per million of GDP as a proxy of the carbon efficiency per unit of output. It is measured in tCO2e/ EUR million GDP.

The portfolio’s emission exposure is 7248 tCO2e, 2,6% higher than the benchmark.

The Weighted Average Carbon intensity is 17,03%, 2,6% higher than the benchmark.

| Portfolio | Share of disclosing holdings | Emission exposure (tCO2e) | WACI (tCO2e/MEur) |

| Etica Impatto Clima | 100% | 7248,32 | 17,03 |

| Benchmark | 100% | 7067,75 | 16,6 |

| Performance | 2,55% | 2,59% |

Sovereign bonds

These metrics are significantly different from those reported last year, i.e. they show a lower level of emissions in absolute terms but a worse performance of Etica’s portfolio compared to the benchmark. This is mainly driven by a change in the methodology employed by ISS to assess government final consumption, formerly grounded on the World Input Output Database (WIOD) and, since 2023, on the OECD Input Output Model. In addition, the emission exposure is now based on the GDP and no longer on countries debt. Therefore, a year-on-year comparison would not be appropriate.

The portfolio still is characterised by a significant overexposure to Italian debt compared to the benchmark. Indeed, Italian debt represents 49% of the total amount invested and it is the major contributor to the portfolio’s overall emission exposure. Note that the methodological shift of relative metrics (i.e. emission exposure) calculus from debt to GDP is not favourable to the Italian carbon footprint, as the absolute amount of Italian debt is higher than its GDP. The Italian debt represents a much lower share in the benchmark index, close to that of France, which is the most represented in the index, and Germany. Both France and Germany have a lower debt to GDP ratio compared to Italy. This might drive the change in the comparison between the portfolio and the benchmark since last year.

References

[1] https://www.issgovernance.com/esg/

[2] Launched after the 2015 Paris Agreement by the Financial Stability Board (FSB), the Task Force on Climate-related Financial Disclosure (TCFD) considers climate transparency as a crucial factor for the stability of financial markets. The objective of the TCFD is therefore to improve climate transparency in financial markets through recommendations on disclosure. These recommendations provide a “consistent framework that improves the ease of both producing and using climate-related financial disclosures”. The TCFD aims to create a unique standard for both corporate and investment disclosure, understanding that local regulatory frameworks may require different compliance levels.

[3] Details on the scenarios and underlying assumptions are available at World Energy Model – Analysis – IEA